Featured

Table of Contents

The catch is that nonprofit Debt Card Financial debt Mercy isn't for every person. InCharge Financial debt Solutions is one of them.

"The other highlight was the attitude of the counselor that we might get this done. I was feeling like it wasn't going to take place, but she kept with me, and we got it done." The Bank Card Forgiveness Program is for individuals who are up until now behind on bank card settlements that they are in significant monetary problem, perhaps dealing with insolvency, and do not have the earnings to catch up."The program is particularly created to assist customers whose accounts have actually been charged off," Mostafa Imakhchachen, customer care professional at InCharge Debt Solutions, claimed.

Creditors that get involved have concurred with the not-for-profit credit report therapy company to accept 50%-60% of what is owed in dealt with regular monthly payments over 36 months. The set repayments mean you know precisely just how much you'll pay over the settlement period. No passion is charged on the balances throughout the reward period, so the payments and amount owed don't change.

However it does show you're taking an active role in lowering your financial debt. Since your account was currently way behind and billed off, your credit rating was already taking a hit. After settlement, the account will be reported as paid with a zero balance, instead of superior with a collections firm.

See This Report about Getting Support From APFSC

The therapist will certainly evaluate your financial resources with you to figure out if the program is the right alternative. The evaluation will certainly include a consider your month-to-month revenue and expenditures. The firm will draw a credit rating record to recognize what you owe and the degree of your challenge. If the forgiveness program is the most effective solution, the therapist will certainly send you an arrangement that details the strategy, consisting of the amount of the month-to-month repayment.

Once everybody agrees, you begin making regular monthly repayments on a 36-month plan. When it's over, the agreed-to amount is eliminated. There's no charge for paying off the balance early, yet no expansions are allowed. If you miss a repayment, the arrangement is nullified, and you should exit the program. If you assume it's a great option for you, call a counselor at a not-for-profit credit rating therapy agency like InCharge Financial obligation Solutions, that can answer your questions and aid you identify if you certify.

Because the program permits customers to opt for much less than what they owe, the creditors who get involved desire reassurance that those that take benefit of it would not have the ability to pay the full quantity. Your charge card accounts likewise must be from financial institutions and bank card companies that have actually concurred to get involved.

About Steps for Get Started Now

If you miss a repayment that's just one missed out on repayment the contract is terminated. Your financial institution(s) will certainly terminate the plan and your balance goes back to the initial amount, minus what you've paid while in the program.

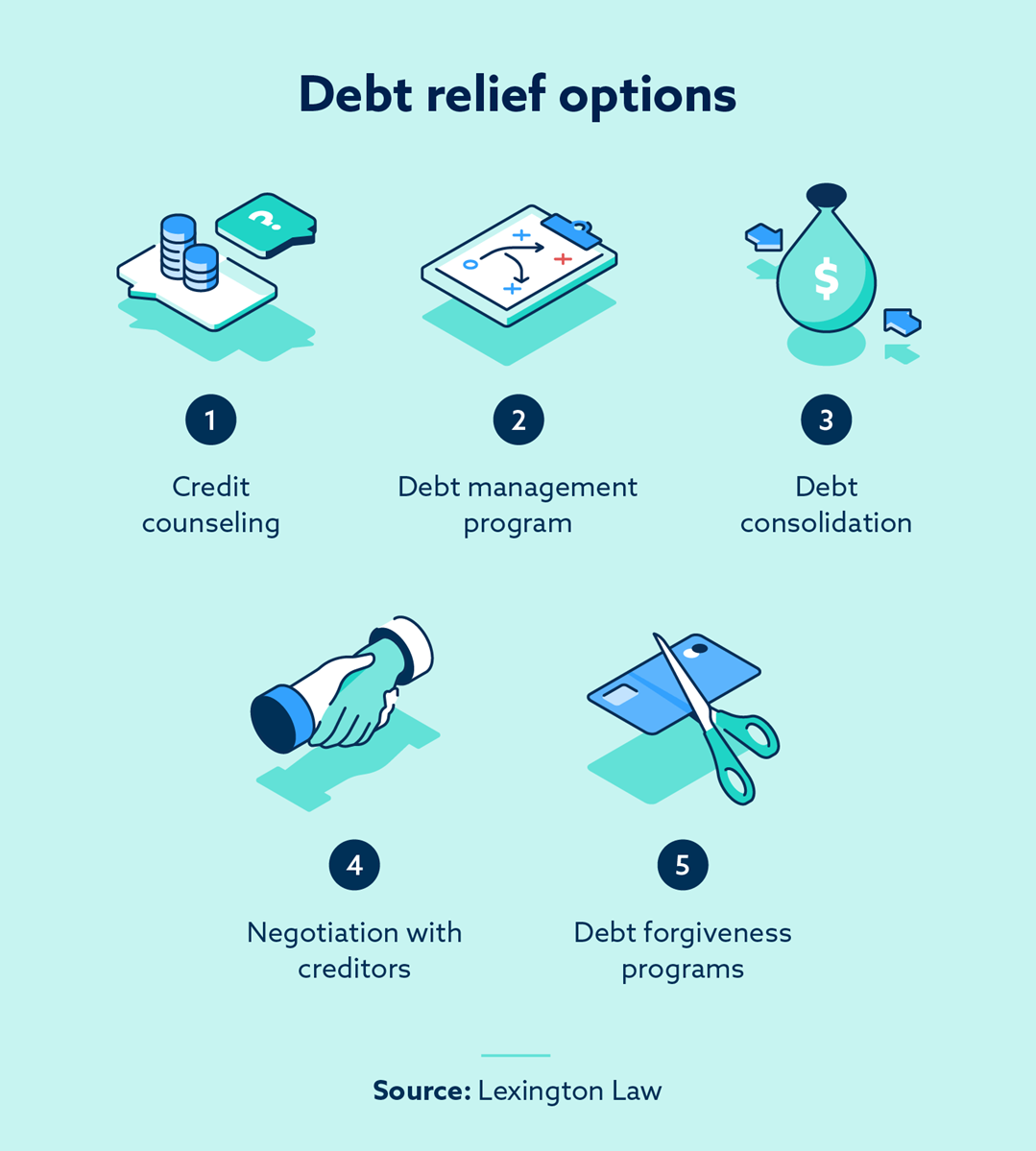

With the mercy program, the lender can instead select to maintain your financial obligation on the books and recover 50%-60% of what they are owed. Nonprofit Credit Report Card Financial debt Forgiveness and for-profit financial debt settlement are similar because they both provide a way to work out credit card financial obligation by paying much less than what is owed.

Bank card mercy is developed to set you back the customer much less, repay the financial obligation quicker, and have fewer downsides than its for-profit equivalent. Some key locations of difference between Charge card Debt Forgiveness and for-profit financial debt negotiation are: Charge card Financial obligation Forgiveness programs have relationships with creditors who have concurred to get involved.

The Main Principles Of Methods APFSC Ensures Legal Compliance

Once they do, the payoff period starts quickly. For-profit financial obligation settlement programs discuss with each financial institution, usually over a 2-3-year duration, while interest, fees and calls from financial obligation collection agencies proceed. This suggests a larger hit on your credit score report and credit rating, and a raising balance till settlement is completed.

Credit Scores Card Financial debt Forgiveness clients make 36 equivalent regular monthly settlements to remove their financial debt. For-profit financial debt negotiation clients pay right into an escrow account over a negotiation period toward a lump amount that will certainly be paid to financial institutions.

Table of Contents

Latest Posts

Some Known Details About The Benefits and Disadvantages of Bankruptcy

Unsecured Debt Forgiveness Solutions Can Be Fun For Anyone

Little Known Facts About Typical Misunderstandings About Bankruptcy.

More

Latest Posts

Some Known Details About The Benefits and Disadvantages of Bankruptcy

Unsecured Debt Forgiveness Solutions Can Be Fun For Anyone

Little Known Facts About Typical Misunderstandings About Bankruptcy.